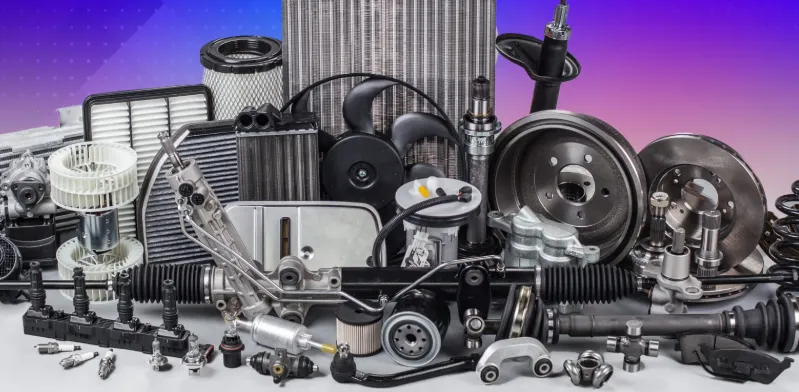

Original Equipment Manufacturer (OEM) parts are components produced either by the original product manufacturer or their authorized suppliers, maintaining identical specifications, materials, and quality standards as those installed during initial production. These parts are distinguished by precise engineering tolerances, certified materials, and rigorous testing protocols that ensure compatibility and performance matching the original equipment. The automotive sector represents the largest consumer of OEM parts, accounting for approximately 38% of global usage, though the concept applies equally to aerospace, electronics, medical devices, and industrial equipment manufacturing. OEM parts typically feature the manufacturer’s branding and proprietary part numbering system, which differentiates them from aftermarket alternatives and facilitates traceability throughout the supply chain.

The production of OEM parts occurs within tightly controlled manufacturing networks where brand owners enforce strict technical specifications and quality standards. Tier 1 suppliers operate under long-term contracts that include material traceability requirements compliant with ISO 9001:2015 standards, production process validation protocols, and regular quality audits conducted by OEM representatives. These components must meet exact engineering criteria established during the original product development phase, including dimensional tolerances often held within ±0.05mm for precision components, certified material compositions meeting ASTM, EN, or JIS standards, and validated performance characteristics such as fatigue life and thermal resistance. In the automotive industry, critical engine components undergo validation testing exceeding 5,000 hours to ensure reliability under extreme operating conditions.

The production of OEM parts occurs within tightly controlled manufacturing networks where brand owners enforce strict technical specifications and quality standards. Tier 1 suppliers operate under long-term contracts that include material traceability requirements compliant with ISO 9001:2015 standards, production process validation protocols, and regular quality audits conducted by OEM representatives. These components must meet exact engineering criteria established during the original product development phase, including dimensional tolerances often held within ±0.05mm for precision components, certified material compositions meeting ASTM, EN, or JIS standards, and validated performance characteristics such as fatigue life and thermal resistance. In the automotive industry, critical engine components undergo validation testing exceeding 5,000 hours to ensure reliability under extreme operating conditions.

Quality assurance processes for OEM parts incorporate statistical process control (SPC) with CpK values exceeding 1.33 for critical characteristics, 100% inspection protocols for safety-related components, and comprehensive batch testing with retained samples. The aerospace sector imposes additional requirements through NADCAP accreditation for special processes including non-destructive testing and heat treatment of structural components. Different industries utilize OEM parts for specific applications – automotive manufacturers rely on them for engine components, electrical systems, and precisely color-matched body panels, while the aerospace industry requires FAA-approved structural elements, turbine blades with controlled crystal structures, and military-grade avionics. Medical device OEM parts must meet FDA clearance standards for implantable components and maintain sterilization compatibility for surgical instruments.

Market dynamics for OEM parts demonstrate significant price premiums of 30-300% over aftermarket alternatives, reflecting the costs of research and development, lower production volumes, extended warranty obligations, and brand value preservation. The global OEM parts market reached a valuation of $1.2 trillion in 2023, with projections indicating a 4.7% compound annual growth rate through 2030. Legal frameworks governing OEM parts distribution include patent protections for proprietary designs, trademark restrictions on packaging and labeling, and warranty implications for non-OEM part usage, with regional variations such as the European Union’s Block Exemption Regulation (BER) specifically addressing automotive aftermarket availability. Modern OEM parts increasingly incorporate technological enhancements including RFID tags for authenticity verification, embedded sensors for performance monitoring, and blockchain-based supply chain tracking to combat the $75 billion global counterfeit parts market, as exemplified by Boeing’s Trusted Trace program in the aerospace sector.

Environmental considerations are driving changes in OEM parts manufacturing, with pressure to reduce material waste, improve component recyclability, develop remanufactured part programs, and implement carbon-neutral production processes. The automotive industry has reported 12-15% improvements in material efficiency since 2015 through advanced forming technologies. Future development trends point toward increased use of sustainable materials, AI-driven predictive replacement systems, on-demand digital manufacturing capabilities, and enhanced cybersecurity measures for connected components. These innovations aim to maintain the value proposition of OEM parts while addressing cost competitiveness challenges in evolving industrial landscapes, ensuring continued relevance across manufacturing sectors that demand guaranteed compatibility, performance, and reliability.